Equity | Markets

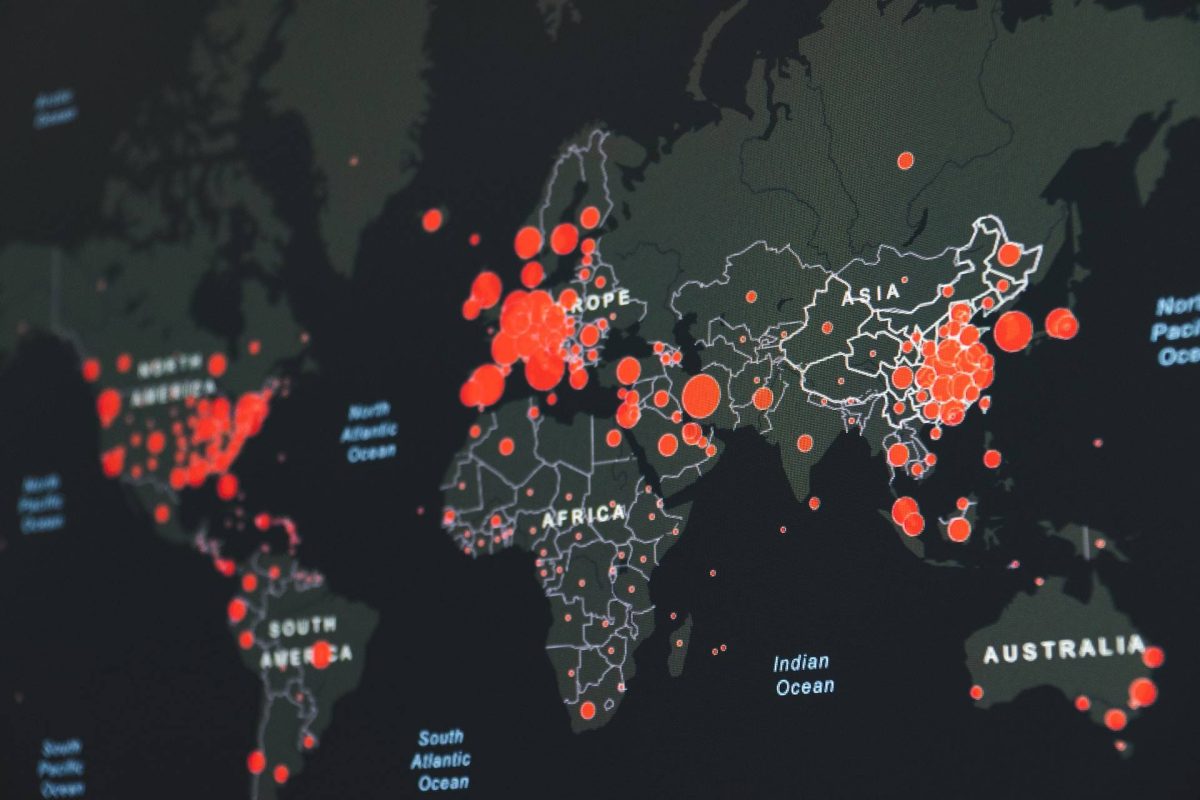

Despite a historic winning streak, American investors should consider diversifying their portfolios with international shares for better risk-adjusted returns.

Unsplash Images

In a recent surprising statement, former Treasury Secretary turned private-equity investor, Steven Mnuchin, expressed his unwavering faith in the US economy, suggesting that if given the chance, he would invest 100% of his money in America for the next decade.

Mnuchin’s sentiment is not uncommon, as American investors tend to allocate just a fraction of their equity investments overseas, defying the principles of diversification. Even renowned figures like Jack Bogle and Warren Buffett advocate for a predominantly American-focused investment strategy.

However, this home bias contradicts the foundational principle of modern finance: diversification. The importance of diversification was highlighted by economist Harry Markowitz in the 1950s when he introduced portfolio theory, emphasizing the need to consider risk alongside expected returns. Markowitz demonstrated that a portfolio containing a mix of assets with non-correlated performance, such as Andy’s volatile apple farm and Barry’s steady bootmaking business, could offer better risk-adjusted returns than investing solely in one of them.

Markowitz’s groundbreaking work paved the way for concepts like index funds, pioneered by Bogle, and the capital-asset-pricing model developed by economist William Sharpe. Diversification is beneficial at all levels of portfolio construction, whether it involves holding shares in multiple companies, diversifying across different asset classes, or investing in various countries.

While patriotism and a belief in the strength of the American economy may explain the home bias, there are compelling reasons to consider international diversification. American companies have a significant global presence, and economic growth tends to be interconnected across countries. However, there are risks that cannot be captured by volatility measures, and concentrating investments solely in one country exposes investors to regulatory and political risks.

Historically, American stocks have outperformed global markets for an exceptionally long period of three decades. Since 1990, the average annual return of American stocks has been 4.6 percentage points higher than a broad index of rich-world stocks—an unusually large premium. This prolonged outperformance has led to American stocks representing a substantial 60% of global market capitalization, despite the US economy accounting for only 25% of the world’s GDP.

However, it is essential to critically evaluate the sustainability of this winning streak. A recent paper by Cliff Asness and colleagues at AQR Capital Management raises concerns about the underlying factors driving American stock outperformance. The study suggests that a significant portion of the premium is due to inflated valuations rather than strong fundamentals. Of the 4.6% premium, a substantial 3.4% is attributed to increased price-to-earnings ratios, with only 1.2% stemming from actual improvements in earnings.

While past performance driven by strong fundamentals can be replicable, relying on elevated valuations as the primary driver of outperformance is inherently risky. As the market dynamics shift, diversification becomes increasingly relevant. Despite the potential apprehension of investing in foreign stocks after a prolonged winning streak for American stocks, the case for diversification is being reaffirmed.

The United States possesses robust capital markets, strong institutions, and a large economy. These factors have long been factored into stock prices. Therefore, it is prudent for American investors to embrace the global opportunities available and consider expanding their investment horizons beyond their home country. Being the land of the brave should also mean venturing abroad for better risk-adjusted returns and increased portfolio resilience.

Copyright © Capital Insights 2024. All rights reserved.